St Charles County Missouri Real Estate Taxes . The senior citizen real estate property tax freeze applies to st. Charles county collector’s office located at. This site shows the current owner of real estate and the history of taxes on the specific parcel. The sale is held in accordance with chapter 140 rsmo. Payments may be made at the st. The assessment authority (assessor’s office) is responsible for establishing the fair market value of all property within st. Discover a complete directory of resources and official websites for property records in st. All 2022 and prior real estate taxes must be paid in full to prevent their offering in the 2024 tax certificate sale. The assessment authority ( assessor’s office) is responsible for establishing the fair market value of all property within st. This assures the tax burden is. It does not display historical ownership. Charles county as of the tax date. Personal property and real estate taxes are paid to st. Charles county residents who were at least 62 years old as of jan.

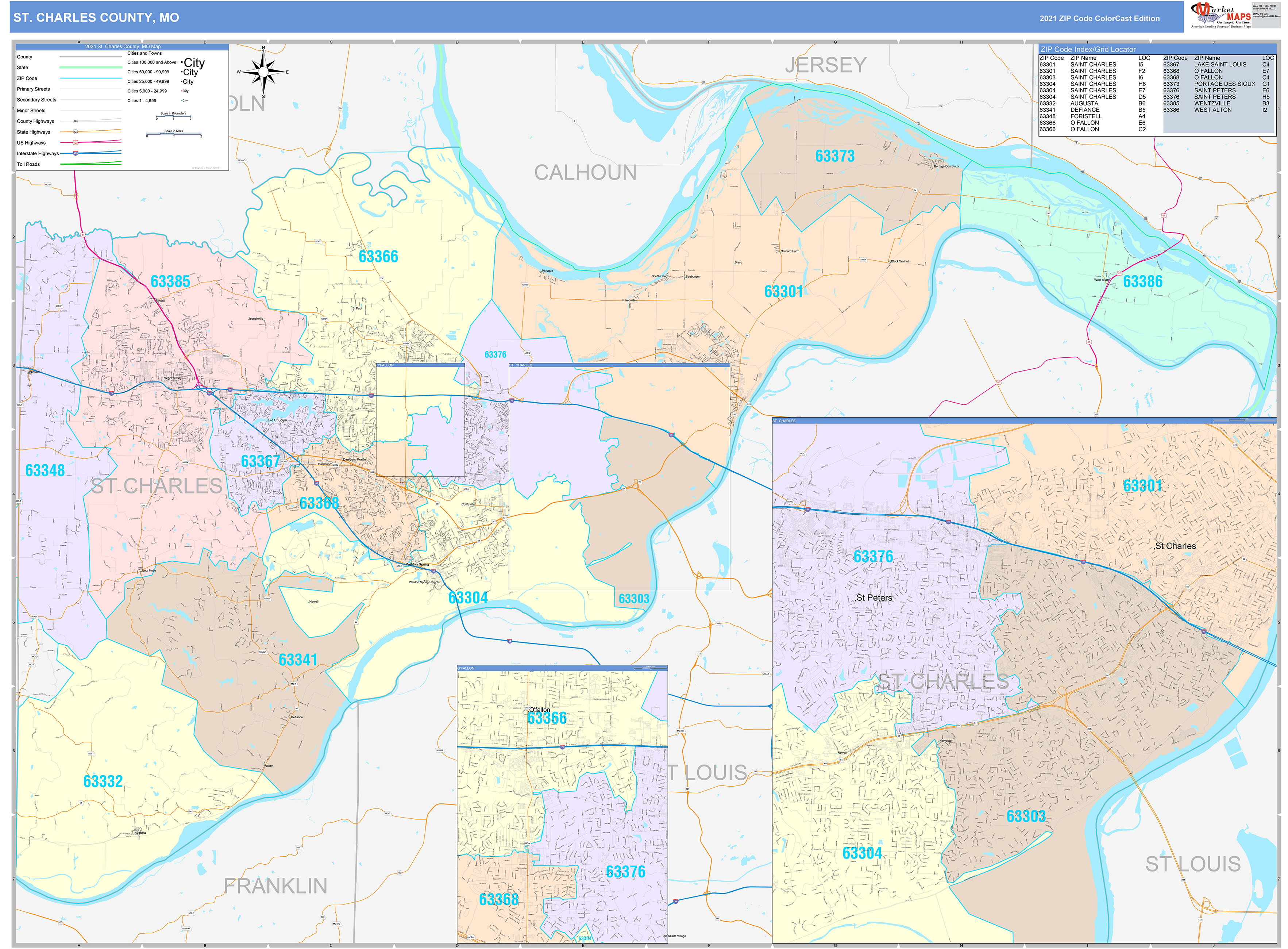

from www.mapsales.com

The senior citizen real estate property tax freeze applies to st. Charles county collector’s office located at. This site shows the current owner of real estate and the history of taxes on the specific parcel. Discover a complete directory of resources and official websites for property records in st. All 2022 and prior real estate taxes must be paid in full to prevent their offering in the 2024 tax certificate sale. Charles county residents who were at least 62 years old as of jan. This assures the tax burden is. Charles county as of the tax date. It does not display historical ownership. The assessment authority ( assessor’s office) is responsible for establishing the fair market value of all property within st.

St. Charles County, MO Wall Map Color Cast Style by MarketMAPS

St Charles County Missouri Real Estate Taxes The assessment authority ( assessor’s office) is responsible for establishing the fair market value of all property within st. The assessment authority ( assessor’s office) is responsible for establishing the fair market value of all property within st. Charles county residents who were at least 62 years old as of jan. The sale is held in accordance with chapter 140 rsmo. This assures the tax burden is. Charles county collector’s office located at. It does not display historical ownership. Charles county as of the tax date. The senior citizen real estate property tax freeze applies to st. The assessment authority (assessor’s office) is responsible for establishing the fair market value of all property within st. This site shows the current owner of real estate and the history of taxes on the specific parcel. Discover a complete directory of resources and official websites for property records in st. All 2022 and prior real estate taxes must be paid in full to prevent their offering in the 2024 tax certificate sale. Payments may be made at the st. Personal property and real estate taxes are paid to st.

From www.land.com

25 acres in Saint Charles County, Missouri St Charles County Missouri Real Estate Taxes Discover a complete directory of resources and official websites for property records in st. Charles county collector’s office located at. Personal property and real estate taxes are paid to st. All 2022 and prior real estate taxes must be paid in full to prevent their offering in the 2024 tax certificate sale. The assessment authority ( assessor’s office) is responsible. St Charles County Missouri Real Estate Taxes.

From www.semashow.com

St Louis County Mo Real Estate Tax Lookup St Charles County Missouri Real Estate Taxes The assessment authority (assessor’s office) is responsible for establishing the fair market value of all property within st. Charles county as of the tax date. The sale is held in accordance with chapter 140 rsmo. Personal property and real estate taxes are paid to st. This site shows the current owner of real estate and the history of taxes on. St Charles County Missouri Real Estate Taxes.

From www.stltoday.com

St. Charles County puts real estate, personal property tax bills on St Charles County Missouri Real Estate Taxes Charles county collector’s office located at. Discover a complete directory of resources and official websites for property records in st. The senior citizen real estate property tax freeze applies to st. Charles county as of the tax date. This assures the tax burden is. The assessment authority (assessor’s office) is responsible for establishing the fair market value of all property. St Charles County Missouri Real Estate Taxes.

From www.istockphoto.com

Location Map Of The Saint Charles County Of Missouri Usa Stock St Charles County Missouri Real Estate Taxes Charles county residents who were at least 62 years old as of jan. Discover a complete directory of resources and official websites for property records in st. It does not display historical ownership. Charles county as of the tax date. This assures the tax burden is. Payments may be made at the st. The assessment authority ( assessor’s office) is. St Charles County Missouri Real Estate Taxes.

From www.landsofamerica.com

3.04 acres in Saint Charles County, Missouri St Charles County Missouri Real Estate Taxes Discover a complete directory of resources and official websites for property records in st. The senior citizen real estate property tax freeze applies to st. All 2022 and prior real estate taxes must be paid in full to prevent their offering in the 2024 tax certificate sale. The assessment authority ( assessor’s office) is responsible for establishing the fair market. St Charles County Missouri Real Estate Taxes.

From www.landsofamerica.com

30 acres in Saint Charles County, Missouri St Charles County Missouri Real Estate Taxes The senior citizen real estate property tax freeze applies to st. It does not display historical ownership. Payments may be made at the st. All 2022 and prior real estate taxes must be paid in full to prevent their offering in the 2024 tax certificate sale. Charles county residents who were at least 62 years old as of jan. Discover. St Charles County Missouri Real Estate Taxes.

From diaocthongthai.com

Map of St. Charles County, Missouri Thong Thai Real St Charles County Missouri Real Estate Taxes All 2022 and prior real estate taxes must be paid in full to prevent their offering in the 2024 tax certificate sale. Charles county residents who were at least 62 years old as of jan. Payments may be made at the st. Charles county as of the tax date. The sale is held in accordance with chapter 140 rsmo. The. St Charles County Missouri Real Estate Taxes.

From www.countryhomesofamerica.com

2.2 acres in Saint Charles County, Missouri St Charles County Missouri Real Estate Taxes The senior citizen real estate property tax freeze applies to st. This site shows the current owner of real estate and the history of taxes on the specific parcel. Personal property and real estate taxes are paid to st. The assessment authority ( assessor’s office) is responsible for establishing the fair market value of all property within st. The sale. St Charles County Missouri Real Estate Taxes.

From www.landwatch.com

Defiance, Saint Charles County, MO House for sale Property ID St Charles County Missouri Real Estate Taxes Personal property and real estate taxes are paid to st. Discover a complete directory of resources and official websites for property records in st. The sale is held in accordance with chapter 140 rsmo. Payments may be made at the st. All 2022 and prior real estate taxes must be paid in full to prevent their offering in the 2024. St Charles County Missouri Real Estate Taxes.

From loridillick.com

Things to Do in St. Charles County, MO Lori Dillick St Charles County Missouri Real Estate Taxes The assessment authority ( assessor’s office) is responsible for establishing the fair market value of all property within st. Personal property and real estate taxes are paid to st. The sale is held in accordance with chapter 140 rsmo. Charles county collector’s office located at. This assures the tax burden is. Charles county residents who were at least 62 years. St Charles County Missouri Real Estate Taxes.

From www.theappraisalteaminc.com

Real Estate Appraiser Warren County, MO 2472 Hour Turnaround Time St Charles County Missouri Real Estate Taxes The sale is held in accordance with chapter 140 rsmo. It does not display historical ownership. Discover a complete directory of resources and official websites for property records in st. This assures the tax burden is. The assessment authority ( assessor’s office) is responsible for establishing the fair market value of all property within st. Personal property and real estate. St Charles County Missouri Real Estate Taxes.

From www.land.com

17 acres in Saint Charles County, Missouri St Charles County Missouri Real Estate Taxes This assures the tax burden is. Charles county residents who were at least 62 years old as of jan. Discover a complete directory of resources and official websites for property records in st. Personal property and real estate taxes are paid to st. All 2022 and prior real estate taxes must be paid in full to prevent their offering in. St Charles County Missouri Real Estate Taxes.

From sharedocnow.blogspot.com

St Louis County Personal Property Tax Receipt Online sharedoc St Charles County Missouri Real Estate Taxes Charles county as of the tax date. Personal property and real estate taxes are paid to st. This assures the tax burden is. Discover a complete directory of resources and official websites for property records in st. The assessment authority ( assessor’s office) is responsible for establishing the fair market value of all property within st. Payments may be made. St Charles County Missouri Real Estate Taxes.

From www.landsofamerica.com

3.15 acres in Saint Charles County, Missouri St Charles County Missouri Real Estate Taxes The assessment authority ( assessor’s office) is responsible for establishing the fair market value of all property within st. The assessment authority (assessor’s office) is responsible for establishing the fair market value of all property within st. Discover a complete directory of resources and official websites for property records in st. Charles county as of the tax date. The sale. St Charles County Missouri Real Estate Taxes.

From www.landwatch.com

Wentzville, Saint Charles County, MO Farms and Ranches, Undeveloped St Charles County Missouri Real Estate Taxes Charles county as of the tax date. The sale is held in accordance with chapter 140 rsmo. Charles county residents who were at least 62 years old as of jan. The assessment authority ( assessor’s office) is responsible for establishing the fair market value of all property within st. Payments may be made at the st. All 2022 and prior. St Charles County Missouri Real Estate Taxes.

From www.mapsales.com

St. Charles County, MO Wall Map Color Cast Style by MarketMAPS St Charles County Missouri Real Estate Taxes Charles county collector’s office located at. The senior citizen real estate property tax freeze applies to st. Discover a complete directory of resources and official websites for property records in st. Charles county as of the tax date. Personal property and real estate taxes are paid to st. The assessment authority (assessor’s office) is responsible for establishing the fair market. St Charles County Missouri Real Estate Taxes.

From patch.com

St. Charles County Offices Open Today for Tax Payments Wentzville, MO St Charles County Missouri Real Estate Taxes This assures the tax burden is. Charles county collector’s office located at. This site shows the current owner of real estate and the history of taxes on the specific parcel. The sale is held in accordance with chapter 140 rsmo. Payments may be made at the st. Personal property and real estate taxes are paid to st. Charles county residents. St Charles County Missouri Real Estate Taxes.

From www.formsbank.com

Form Ptax 340 Senior Citizens Assessment Freeze Homestead Exemption St Charles County Missouri Real Estate Taxes It does not display historical ownership. Charles county collector’s office located at. All 2022 and prior real estate taxes must be paid in full to prevent their offering in the 2024 tax certificate sale. The sale is held in accordance with chapter 140 rsmo. The assessment authority (assessor’s office) is responsible for establishing the fair market value of all property. St Charles County Missouri Real Estate Taxes.